As a Chief Restructuring Officer speaking directly to seed or Series A startup founders, let’s delve into a topic that should be at the forefront of your strategic planning: Product-Market Fit (PMF). In the startup world, PMF isn’t just a concept—it’s the indicator that your startup should scale and is the beginning of your next fundraising milestone. Whether you’re planning for the year, looking to fundraise, or need cash fast, your startup should be evaluating where you’re at with PMF.

What is Product Market Fit?

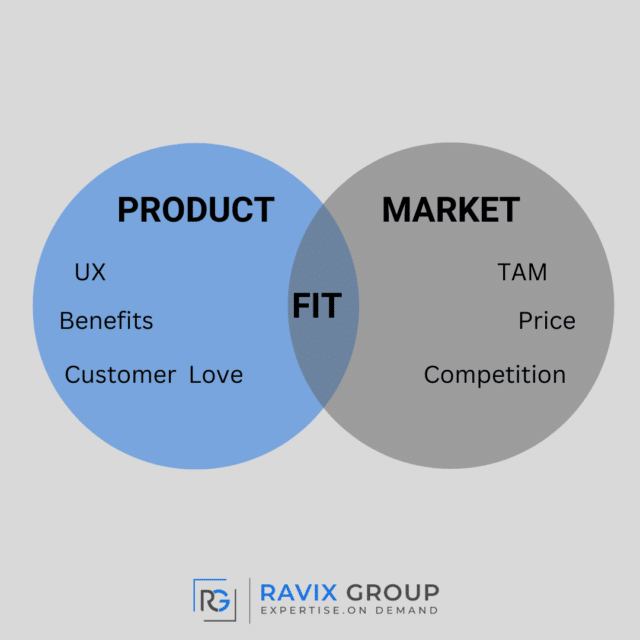

Product-market fit occurs when your product perfectly satisfies a significant demand in the market as defined by your TAM data and your Ideal Customer Profile (ICP). It’s akin to finding the right key for a specific lock. Your product is the key, and the market demand is the lock. When they align seamlessly, that’s PMF. It’s been an amorphous concept for startups, much like the dreaded zone of insolvency; you will flirt with PMF after you launch, and as your product and the market evolve, so does PMF. It’s important to track certain metrics and continually monitor customer satisfaction in order to prove PMF.

The Critical Nature of Product-Market Fit

1. Sustainability: Product market fit means your customers are happy and buying and will repeatedly purchase your product because they can’t live without it. This will help your startup move into a sustainable revenue phase, which is attractive to the next round of investors.

2. Growth Potential: PMF is the bedrock of scalable growth. It’s the point where your product naturally aligns with customer needs, shifting from you pushing the product to customers pulling it from you. If you can manage to nail down PMF, you can look for new channels to bring in more happy customers.

3. Resource Utilization: Startups often operate with constrained resources. PMF ensures that these precious resources are invested in a product that meets real market needs.

4. Investor Confidence: Let’s be honest; most investors are looking for “Product Market Fit” and won’t even look at your startup without it. It’s essential you not only have it, but prove it with metrics and tell the story to investors while seeking startup financing.

Self-Evaluation for Founders

To determine whether your startup has achieved PMF, ask yourself these questions:

1. Do customers recommend my product? A strong indicator of PMF is when users actively refer your product to others. Use the Net Promoter Score (NPS) or Harvard Business Review’s Net Promoter 3.0 to calculate and measure.

2. Is my customer base growing organically? A growing customer base, especially without substantial marketing efforts, is a telltale sign of PMF. Look at the sources of your customers and their cohorts (if measuring), and if your LTV to CAC is falling below a 3.5, you need to re-evaluate. Anything in the 4-7 range is desirable.

3. Are sales cycles becoming shorter? As PMF is honed, the sales process should become more straightforward and quicker as you’re able to identify customer pain points in your marketing efforts early in the sales cycle. This will create a “magnet” effect, drawing in more customers faster.

4. Do I observe repeat purchases or sustained usage? This suggests that your product delivers lasting value to your customers.

5. Am I meeting my business objectives/goals? Regularly achieving or surpassing key business metrics is a positive sign of PMF.

The Superhuman Startup Product-Market Fit Engine

I recommend founders explore the Startup Product Market Fit engine created by Rahul Vohra at Superhuman. It offers a quantifiable and actionable approach to measuring PMF. This method involves surveying how disappointed users would be if they could no longer use your product, aiming for at least 40% to report being ‘very disappointed.’ This metric not only helps gauge PMF but also provides critical insights into user satisfaction and areas needing improvement.

Actionable Steps Toward Achieving PMF

1. Customer Feedback: Actively seek and analyze customer feedback. It’s vital for understanding their needs and how well your product meets them. In the Superhuman example, when 40% of customers would be “dissatisfied” if your product were no longer available, you’re at PMF.

2. Market Trends: Stay attuned to market trends and evolving customer preferences. PMF is not static; it changes as market conditions evolve. Competitors adding even one feature could change your PMF (see OpenAI).

3. Product Adjustments: Be prepared to iterate your product based on feedback and market research. Adaptability is key to achieving and maintaining PMF.

4. Performance Metrics: Regularly review your performance metrics. They are your reality check on whether your strategies align with market demands. Customer Churn, Customer Retention, LTV to CAC, NPS, can all be indicators on your dashboard and featured in your next pitch deck to prove you’ve hit your startup PMF stride.

PMF is more than a milestone; it’s a continuous journey of aligning your product with market demands. It’s about creating a product that not only meets a need but does so in a way that resonates powerfully with your target audience. As a startup founder, especially in the early stages, your primary focus should be on achieving and sustaining PMF. Tools like the Superhuman PMF engine and the NPS can provide an objective measure of where you stand and guide you on the path to improvement.

Ravix Group often provides fractional CFOs to assist startups in understanding and managing their dashboard for PMF insights. Monitoring churn and retention, LTV to CAC, and a startup fractional CFO, when used effectively, might be the difference in achieving PMF. Curious if you’ve hit PMF? Contact us today for a one-hour consult with a startup finance expert to review your metrics today: